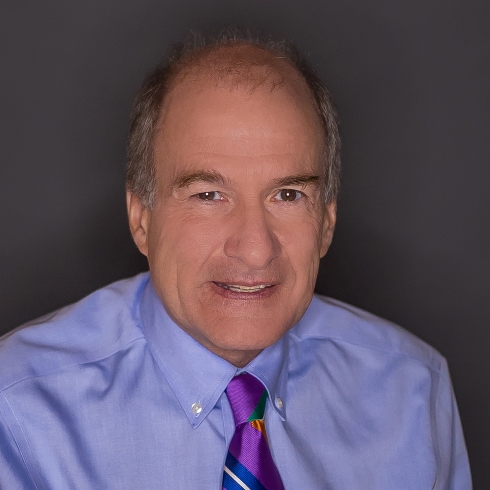

Overview

For over three decades, Jim Lanham has provided a full spectrum of legal services to individuals, families, and businesses as they plan for the future. Utilizing sophisticated wealth planning techniques, Jim delivers personal and individualized advice to each and every client, focusing on the nuances that make every client’s situation unique. He has recently been recognized for his skills in this area by the American College of Trust and Estate Counsel, which invited him to join the organization as a Fellow. In addition to his work with estate planning, Jim advises a number of businesses on governance and acquisitions, and is a licensed title agent along with handling commercial and residential real estate deals.

In addition to his responsibilities to his clients, Jim has contributed his time to numerous charitable organizations, including service as Past President of the Wooster Kiwanis Club. He is serving as the Past Chair of Goodwill Industries of Wayne and Holmes Counties. Jim also actively educates others through speaking engagements across the firm’s geographic footprint and as the author of a number of published articles and client alerts on topics related to estate planning, trust, and wealth and succession planning.

<a href="https://www.actec.org/directory/profile/Lanham-James/3c08a9ec-f348-4fce-b25a-468662415402/"><img alt="Fellow The American College of Trust and Estate Counsel" src="https://www.actec.org/assets/1/6/ACTEC_Fellow-150x150.png"></a>