A significant reduction in the federal estate tax exemption may be imminent. A reduction in the exemption amount means a number of Ohioans who have been unconcerned with estate taxes since 2018 may face estate tax liability without proper planning. Ohio repealed its state estate tax effective January 1st, 2013, at which time the Federal estate tax exemption was $5.25 million. In 2018 the Trump administration enacted the Tax Cuts and Jobs Act of 2017, increasing the federal estate tax exemption to $11.18 million with an automatic sunset back to $5.25 million at the end of 2025. The result, fewer than 2000 estates in the entire country incurred federal estate tax in each of the following years. 1 The current estate tax exemption is at an all-time high of $11.7 million,2 but that may not last long. President Joe Biden has signaled a desire to increase federal estate taxes being paid by returning to the exemption and rates applicable in 2009.3 Many pundits were not sure such a change was possible without a Democratic Senate, but the recent Georgia Senate runoff election results suggest changes may be more imminent than anticipated.

The media has been quick to point out that despite the fifty-fifty split in the Senate with tie breaks going to Vice President Kamala Harris, the Democratic party can still be constrained by Republican use of the filibuster.4 Nevertheless, tax proposals enacted under the Congressional Budget Act as budget reconciliation bills cannot be filibustered.5 The Senate typically requires a sixty-vote majority to pass legislation, which makes it hard for the Senate to quickly pass major legislation. The purpose of this requirement is to prevent the majority party from jamming legislation through the Senate. Budget Reconciliation is a legislative maneuver that allows the majority to get around the sixty-vote mandate.6 Budget Reconciliation allows the Senate majority to bypass the filibuster process and pass legislation with only a simple majority, instead of the normal sixty. Because reconciliation is a budget procedure, originally intended to reduce the ever-growing deficit, reconciliation bills are limited to policy changes directly impacting government spending or taxes.7 Hypothetically, Congress can pass up to three reconciliation bills per year, covering revenue, spending and the federal debt limit.8 In practice, only one reconciliation bill per year is typically passed because those topics are often addressed together and, once covered by a bill, that topic cannot be addressed by a second reconciliation bill in the same year.9

Your goal should be to complete your planning before any changes are made to the estate tax exemption. Most experts believe significant changes are coming and will become effective as of either (A) the date Congress votes to pass such legislation; or (B) January 1, 2022.

A reduction in the estate tax exemption could cost millions

Now that you understand the Biden administration desires to and can reduce the estate tax exemption, it is important to understand why that matters. As previously indicated, the current 2021 estate tax exemption is $11.7 million ($23.4 million for a married couple).10 That means the first $11.7 million of your estate will not be subject to any federal estate tax if it is worth $11.7 million or less and you die before Congress changes the exemption. The estate tax exemption also currently serves as the total lifetime exclusion for gift tax purposes—meaning you can currently gift up to $11.7 million dollars during your lifetime without paying any gift tax. Through use of gifting strategies, this also means you can currently move up to $11.7 million out of value out of your estate. This can be an extremely useful planning strategy, especially if you own assets that you anticipate will appreciate significantly over time or are eligible for valuation discounts at the time of transfer.

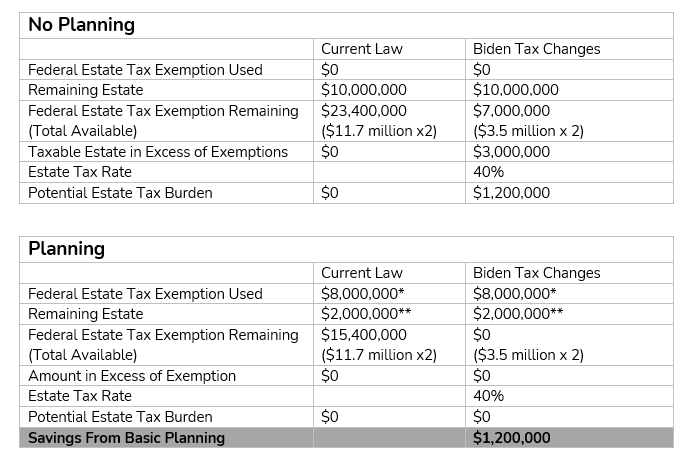

The exemption may never again during your lifetime reach its current all-time high of $11.7 million. Once the exemption changes, so does your ability to move assets out of your estate. It is unclear exactly how low the Biden administration may take the exemption, but estimates have ranged from $5 million to as low as $1.5 million—with the most likely scenario resulting in a $3.5 million exemption. Current guidance suggests that gifts made now will not be subject to clawback if the exemption is lowered in the future11 —meaning you would not be penalized for gifts exceeding any future estate tax exemption if the gifts were made in accordance with existing law at the time of the gift. While typically more complex than the examples below, even the simplest of illustrations demonstrates the potential tax savings resulting from engaging in basic gifting strategies.

You may have also heard that the estate tax exemption is transferrable amongst spouses. The Internal Revenue Service refers to this as portability. It is important to know that portability is not automatically transferred and an estate tax return (IRS Form 706) must be timely filed for a surviving spouse to properly claim the unused portion of a deceased spouse’s exemption.12 Given the current all-time high exemption amount, laying claim to unused exemption may be more important than ever. If you suffered the loss of a spouse in the past nine months and have not claimed their unused exemption, you should speak with your trusted advisors to determine if making such a claim is something you should consider.

Gift now to save later

Your goal should be to complete your planning before any changes are made to the estate tax exemption. Most experts believe significant changes are coming and will become effective as of either (A) the date Congress votes to pass such legislation; or (B) January 1, 2022.13 Despite that generally held belief, the Supreme Court has affirmed the constitutionality of retroactive tax legislation, particularly in this context where Congress would simply be making a change to an already existing tax, as opposed to implementing an entirely new tax.14 Such a scenario would present interesting challenges for estate planning professionals recommending gifting between now and any future reduction in the exemption. For example, a couple could gift $23.4 million out of their estate in January of 2021 just to have Congress reduce the exemption to $7 million in July of 2021 retroactive to January 1, 2021. The estate planning professionals at Critchfield have strategies in place to ensure that any significant gifts or transfers made now in accordance with current estate tax laws will not hurt you in the long run if Congress does retroactively implement a reduction in the estate tax exemption to a time prior to the date of any transfers. This requires sophisticated planning and is something you should be aware of if you are considering gifting strategies to reduce your taxable estate in the coming months.

What Else is Coming Down the Pike?

Other tax law changes experts expect the Biden Administration to target are as follows:

- Elimination of 1031 exchanges15

- Under Section 1031 of the United States Internal Revenue Code, current law permits taxpayers to defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property, a process known as a 1031 exchange.

- Expansion of the Social Security Tax16

- Under current law, a Social Security tax of 12.4% is leveraged on income up to $142,800. The Biden administration has proposed a tax-free gap on income between $142,800 and $400,000 and a reinstitution of the 12.4% tax on income above $400,000.

- Increased capital gains taxes for individuals earning over $1 million17

- In 2020, the capital gains tax maxed out at 20% for those earning $441,451 or more. The Biden plan will tax investment income at the same rate as regular income for those earning over a million dollars.

- Elimination of the step-up in basis18

- Currently, the cost basis of property transferred at death receives a “step-up” in basis to its fair market value at the time of death. This has traditionally eliminated an heir’s capital gains tax liability on appreciation in the property’s value that occurred during the decedent’s lifetime.

- Removal of the current cap on the State and Local Tax (SALT) deduction19

- The SALT deduction allows taxpayers to deduct certain state and local taxes on their federal tax return. Prior to the Trump presidency, there was no limit on the SALT deduction. The Trump Administration capped the deduction at $10,000.

- Reduction in or repeal of the 199A deduction for those making over $400,00020

- The pass-through deduction allows taxpayers to exclude up to 20% of their pass-through business income from federal income tax. The deduction is subject to several limits, intended to prevent abuse, which is based on the economic sector of each business, the amount of business wages paid, and the original cost of business property.

- Restoration of the Pease Limitation21

- “The Pease Limitation effectively reduces the amount one can deduct above a certain threshold. For every dollar of income earned above the threshold, the Pease Limitation reduces the value of itemized deductions by three cents.”22

Examples

MARRIED COUPLE $20,000,000

* In this example, the $17,000,000 moved out of the client’s estate can grow estate tax free from the date of transfer.

**Critchfield will work with you to determine which assets are appropriate for transfer and will coordinate with your other advisors to determine how much you should retain so as to not adversely impact your current standard of living.

MARRIED COUPLE $10,000,000

* In this example, the $8,000,000 moved out of the client’s estate can grow estate tax free from the date of transfer.

**Critchfield will work with you to determine which assets are appropriate for transfer and will coordinate with your other advisors to determine how much you should retain so as to not adversely impact your current standard of living.

Footnotes

- https://www.taxpolicycenter.org/briefing-book/how-many-people-pay-estate-tax, Table 1, Retrieved 1/14/2021.

- https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax, Retrieved 1/14/2021.

- Hodge, Scott A. (October 28, 2020). https://taxfoundation.org/joe-biden-estate-tax-wealth-tax/, Retrieved 1/14/2021.

- Roche, Darragh (January 7, 2021). https://www.newsweek.com/georgia-senate-victory-democrats-kill-filibuster-1559276, Retrieved 1/14/2021.

- Reich, David; Kogan, Richard (November 9, 2016). https://www.cbpp.org/research/federal-budget/introduction-to-budget-reconciliation, Retrieved 1/14/2021.

- https://budget.house.gov/publications/fact-sheet/budget-reconciliation-basics, Retrieved 1/14/2021.

- Id.

- Supra note 5.

- Supra note 5.

- Supra note 2.

- Schreiber, Sally P. (November 25, 2019). https://www.journalofaccountancy.com/news/2019/nov/irs-estate-gift-tax-clawback-rules-201922516.html, Retrieved 1/14/2021

- Supra note 2.

- Shenkman, Martin M., Keebler, Robert S. and Blattmachr, Jonathan G. (January 12, 2021). Presentation: “GA Runoff Elections Concluded: Anticipated Tax Changes Affecting Estate Planning for this and Future Years.”

- United States v. Carlton, 512 U.S. 26 (1994); See also, https://fas.org/sgp/crs/misc/R42791.pdf, Retrieved 1/14/2021.

- Mengle, Rocky (January 7, 2021). https://www.kiplinger.com/taxes/602047/joe-biden-tax-plans-for-the-next-few-years, Retrieved 1/14/2021; See also Shenkman et al., supra note 13.

- Id.

- Id.; See also, Munk, Cheryl Winokur (updated November 7, 2020). https://www.barrons.com/articles/a-biden-presidency-could-complicate-your-estate-taxes-and-planning-start-preparing-now-51603882801, Retrieved 1/14/2021; See also Shenkman et al., supra note 13.

- Wood, Robert (November 2, 2020). https://www.forbes.com/sites/robertwood/2020/11/02/bidens-tax-increase-on-death-that-no-one-is-talking-about/?sh=6450fa03376f, Retrieved 1/14/2021; See Munk, supra note 17; See also Shenkman et al., supra note 13.

- Walczak, Jared (October 20, 2020). https://taxfoundation.org/top-tax-rates-under-biden-tax-plan/, Retrieved 1/14/2021 (suggesting that Biden did not expressly include this as part of his written plan, but that it is a priority of many democrats). See also Shenkman et al., supra note 13.

- See Mengle supra note 15. See also Shenkman et al., supra note 13.

- http://www.crfb.org/papers/understanding-joe-bidens-2020-tax-plan, Retrieved 1/14/2021.; See also Shenkman et al., supra note 13.

- http://www.crfb.org/papers/understanding-joe-bidens-2020-tax-plan, Retrieved 1/14/2021.

Tagged In:estate taxsophisticated estate planningtax planning